Overview

Simplify your financial life with Loanwala Solutions' credit card services! Whether you're looking for cashback, rewards, or travel benefits, we offer a range of credit cards tailored to meet your needs. With easy application processes, attractive interest rates, and exclusive perks, we ensure you get the best value for your spending. Choose Loanwala Solutions for smarter financial management today!

Eligibility Criteria to Apply for Credit Card

Before you apply for credit card, it is important to check whether or not you fulfil the eligibility criteria. Check out the eligibility conditions for Indus Easy Credit Cards below:

- Age: To apply, you must be at least 18 years old. On the other hand, the upper-limit age is 75 years.

- Income: Your net monthly income should be at least Rs.20, 000

- Occupation: All Salaried and Self-Employed individuals can apply

- Credit score: You need to have a good CIBIL score

Benefits of a Credit Card

Secure Alternative to Cash

Financial Emergencies

Increased Purchase Power

Interest-Free Credit

Reward Points

Welcome Benefits

Improves Credit Score

Fuel Surcharge Waiver

Cashback Benefits

Travel Benefits

Documents needed for online credit card application

- No physical documents are required

- Keep your Aadhaar number and PAN card handy to speed up the application process

- Proof of residence if your current address is different form the one in Aadhaar

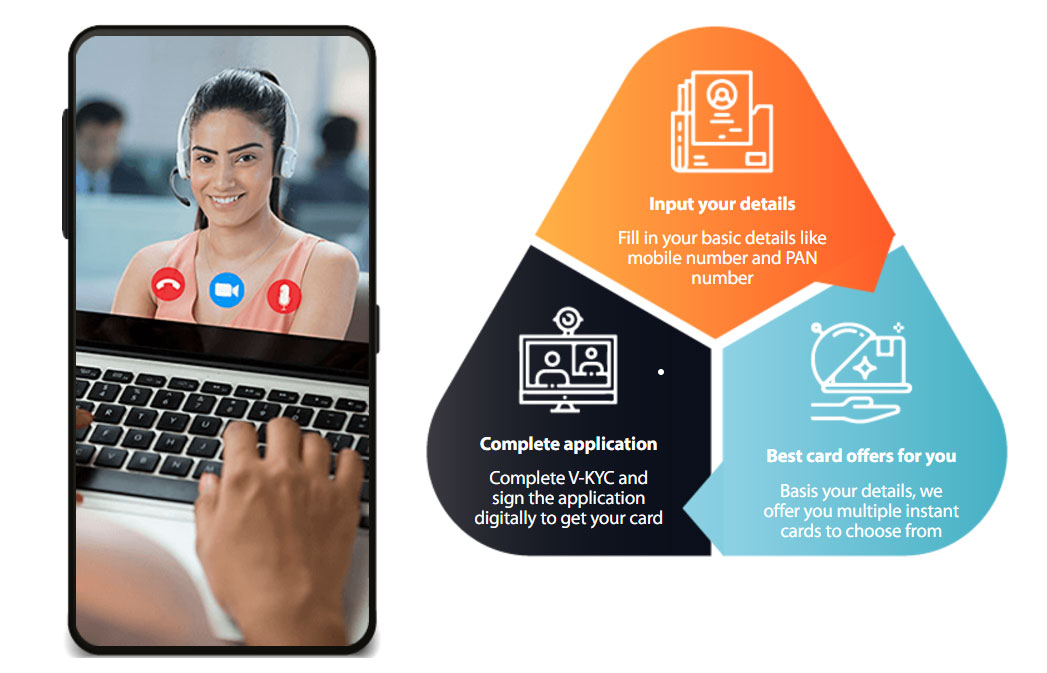

Steps to apply for a Credit Card

Testimonial

Excellent service! The team was professional and guided me throughout. I received the funds quickly without any hassles. Thank you, Loanwala Solutions!

Ravi Hooda

Loanwala Solutions offered flexible repayment options and a smooth process. The team was knowledgeable and very helpful. I highly recommend their services!

Shashi Ahlawat

Quick funding with minimal paperwork! Loanwala Solutions provided me with the perfect solution for my business needs. Fantastic experience!

Sunil Lohia

The best loan provider I’ve worked with! Loanwala Solutions offers reliable service, clear communication, and fast disbursement. Truly a great experience.

Himanshu Satish Sharma

I was impressed by the transparency and customer service at Loanwala Solutions. They truly care about their clients. I’m very satisfied with their support.

Rishi Prakash Sharma

Loanwala Solutions made the loan process so easy and stress-free. Their quick approval and flexible EMIs were exactly what I needed. Highly recommended!

Krishan Gaur

I needed a business loan, but due to some document issues, most lenders rejected my application. Loanwala stepped in and made it happen! Their team was professional, supportive, and ensured a smooth process. Highly recommended for hassle-free loan solutions!"

Ayush Aggarwal

I was struggling to get a personal loan due to my low CIBIL score, but Loanwala made it possible! The process was smooth, quick, and hassle-free. Highly recommend their services!"